Ira Income Contribution Limits 2024

Ira Income Contribution Limits 2024. The irs announced the 2024 ira contribution limits on november 1, 2023. Every year, the irs makes cost of living changes to the ira contributions limits.

For 2024, the ira contribution limit will be $7,000 or $8,000 if you are at least age 50. Here’s what you need to know to maximize your retirement savings in 2024.

For The Tax Year 2024, The Maximum Contribution To A Roth Ira Is $7,000 For Those Younger Than 50 And $8,000 For Those Who Are 50 Or Older.

In addition to the general contribution limit that applies to both roth and traditional iras, your roth ira contribution may be limited.

In 2024, The Annual Contribution Limit For Both Roth And Traditional Iras Rises To $7,000 For Those Under 50, And $8,000 For Those 50 And Above.

Roth ira contribution limits in 2024.

$6,500 (For 2023) And $7,000 (For 2024) If You're Under Age 50;

Images References :

Source: jodieqjocelyn.pages.dev

Source: jodieqjocelyn.pages.dev

Roth Contribution Limits 2024 Caril Cortney, For 2024, you can contribute up to $7,000 in your ira or $8,000 if you’re 50 or older. To contribute to a roth ira, single.

Source: bunniqzaneta.pages.dev

Source: bunniqzaneta.pages.dev

2024 Irs Contribution Limits 401k Cammy Caressa, As noted above, the most you may contribute to your roth and traditional iras for the 2023 tax year is: These limits saw a nice increase, which is due to higher than.

Source: skloff.com

Source: skloff.com

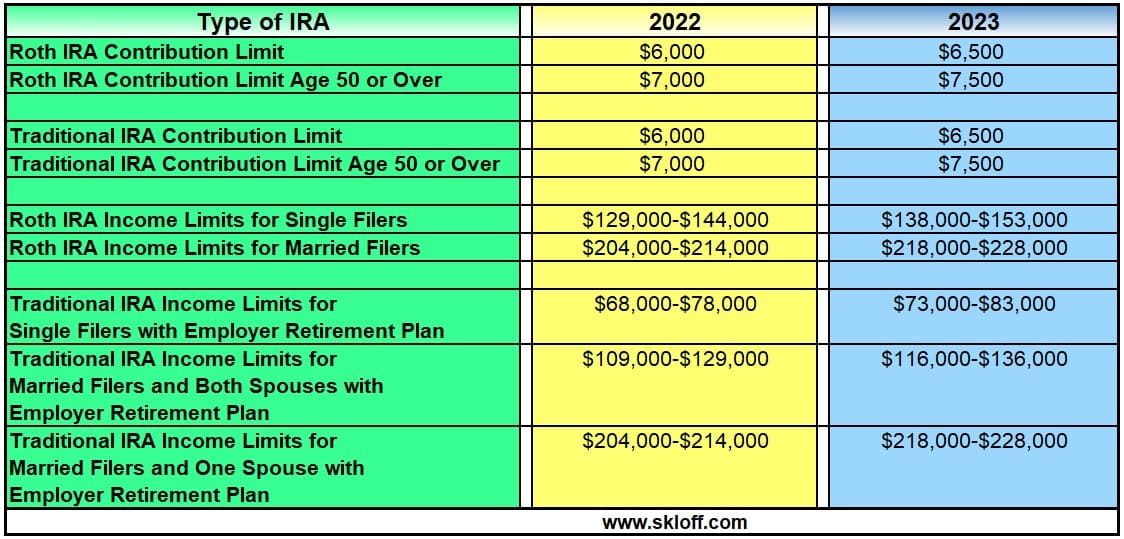

What Are the IRA Contribution and Limits for 2022 and 2023? 02, 2024 roth ira contribution limits and income limits. As noted above, the most you may contribute to your roth and traditional iras for the 2023 tax year is:

Source: jodieqjocelyn.pages.dev

Source: jodieqjocelyn.pages.dev

Roth Contribution Limits 2024 Caril Cortney, This is an increase from 2023, when the limits were $6,500 and $7,500, respectively. The total combined limit for contributing to an ira (including traditional and roth) is:

Source: www.financestrategists.com

Source: www.financestrategists.com

IRA Contribution Limits 2024 Finance Strategists, Find out if you can contribute and if you make too much money for a tax deduction. In 2024, you can contribute up to $7,000 to a traditional ira, a roth ira, or a combination of the two.

Source: jodieqjocelyn.pages.dev

Source: jodieqjocelyn.pages.dev

Roth Contribution Limits 2024 Caril Cortney, Roth ira contribution limits are based on two things: For 2024, you can contribute up to $7,000 in your ira or $8,000 if you’re 50 or older.

Source: caroqbridget.pages.dev

Source: caroqbridget.pages.dev

Wheda Limits 2024 Sonni Olympe, Roth ira contribution limits in 2024. The irs announced the 2024 ira contribution limits on november 1, 2023.

Source: themilitarywallet.com

Source: themilitarywallet.com

2024 Traditional and Roth IRA and Contribution Limits, Find out if you can contribute and if you make too much money for a tax deduction. The ira contribution limits for 2023 are $6,500 for those under age 50 and $7,500 for those 50 and older.

Source: www.blog.passive-income4u.com

Source: www.blog.passive-income4u.com

IRA Contribution Limits And Limits For 2023 And 2024, Check out the new ira contribution limits and roth ira income limits below, and see just how much more you can save for retirement in 2024 with your iras. These limits saw a nice increase, which is due to higher than.

Source: topdollarinvestor.com

Source: topdollarinvestor.com

What Is a Backdoor Roth IRA Benefits and How to Convert Top Dollar, For 2024, the ira contribution limit will be $7,000 or $8,000 if you are at least age 50. For 2024, the ira contribution limits are $7,000 for those under age 50 and $8,000 for those age 50 or older.

For The Tax Year 2024, The Maximum Contribution To A Roth Ira Is $7,000 For Those Younger Than 50 And $8,000 For Those Who Are 50 Or Older.

Roth ira contribution limits for 2023 and 2024.

$6,500 In 2023 And $7,500 For Those Age 50 And Older.

Every year, the irs makes cost of living changes to the ira contributions limits.